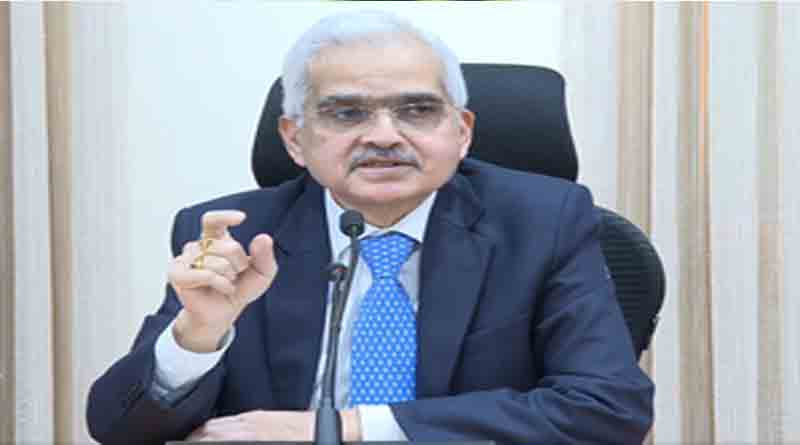

Frequency of reporting credit info to CICs being cut to 15 days or less: RBI chief

Insight Online News

Mumbai, Aug 8 : The RBI proposes to increase the frequency of reporting of credit information to credit information companies (CICs) to a fortnightly basis or at shorter intervals, the central bank’s Governor Shanktikanta Das said on Thursday.

The availability of accurate credit information is vital for both lenders and borrowers. At present, lenders are required to report credit information to credit information companies (CICs) on a monthly basis or at such shorter intervals as may be agreed between the lenders and the CICs.

Credit Information Companies, or CICs, are independent third-party institutions that gather financial data regarding loans, credit cards, and more about individuals and share it with their members, such as banks and Non-Banking Financial Institutions (NBFCs).

Currently, there are four credit information companies registered with the RBI. These are Credit Information Bureau (India) Limited (CIBIL), Equifax Credit Information Services Private Limited, Experian Credit Information Company of India Private Limited, and CRIF High Mark.

What you need to know about a credit report:

A credit report is a summary of an individual’s financial transactions submitted to the Credit Information Corporation (CIC). The CIC has the authority to gather and collate these reports under Republic Act 9510.

*A credit report contains your basic information such as your name, TIN, SSS or GSIS numbers, place of residence, employer, and business. It will also include all of your loan contracts with lending institutions, utility subscriptions, and other obligations which the CIC is authorized to collect.

*Your credit report can only be accessed with your explicit authorisation. This access is limited only to yourself or the financial entity you are transacting with.

*In the process of obtaining a loan or service, you may be asked by the lender or service provider to sign a waiver of access. Your credit report will allow the lender or service provider to assess your application in a fair and objective manner. In general, people with good track records of payment may receive lower interest rates or more services than those with poor payment track records.