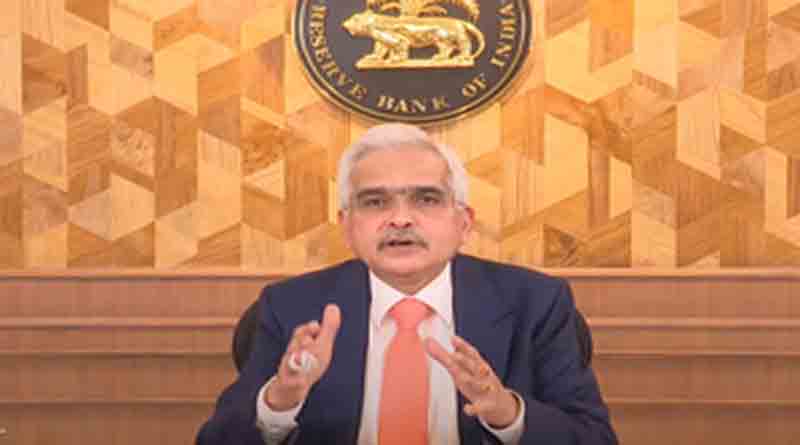

India’s growth story remains intact, real GDP likely to grow at 7.2 pc in FY25: RBI Guv

Insight Online News

New Delhi, Oct 22 : India’s growth story remains intact as its fundamental drivers – consumption and investment demand – are gaining momentum, the RBI Governor Shaktikanta Das has stressed, adding that the country is likely to see real GDP growth at 7.2 per cent for FY 2024-25.

Prospects of private consumption, the mainstay of aggregate demand, look bright on the back of improved agricultural outlook and rural demand.

Sustained buoyancy in services would also support urban demand. Government expenditure of the centre and the states is expected to pick up pace in line with the Budget Estimates,” Das said in the RBI’s monthly bulletin.

“Investment activity would benefit from consumer and business optimism, government’s continued thrust on capex and healthy balance sheets of banks and corporates,” he added.

Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.2 per cent, with Q2 at 7.0 per cent; Q3 at 7.4 per cent; and Q4 at 7.4 per cent. Real GDP growth for Q1 2025-26 is projected at 7.3 per cent, according to the RBI document.

Meanwhile, the CPI inflation for 2024-25 is projected at 4.5 per cent, with Q2 at 4.1 per cent; Q3 at 4.8 per cent; and Q4 at 4.2 per cent. CPI inflation for Q1 2025-26 is projected at 4.3 per cent.

“The CPI print for the month of September is expected to see a big jump due to unfavourable base effects and pick up in food price momentum, caused by the lingering effects of a shortfall in the production of onion, potato and chana dal (gram) in 2023-24, among other factors,” Das mentioned.

The RBI Governor further stated that domestic growth has sustained its momentum, with private consumption and investment growing in tandem.

“Resilient growth gives us the space to focus on inflation so as to ensure its durable descent to the 4 per cent target. Keeping in view the prevailing inflation and growth conditions and the outlook, the MPC considered it appropriate to change the stance to ‘neutral’ and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth,” he noted.

Moving forward, the Reserve Bank will continue to be nimble and flexible in its liquidity management operations.

“We will deploy an appropriate mix of instruments to modulate both frictional and durable liquidity so as to ensure that money market interest rates evolve in an orderly manner,” Das maintained.